Montecarlo Simulation: A Comprehensive Guide for Algorithmic Traders

Monte Carlo simulation is a powerful tool used by algorithmic traders to model the potential outcomes of a trading strategy. This simulation method, which takes its name from the Monte Carlo Casino in Monaco, is used to model the probability of different outcomes in a given situation.

In this comprehensive guide, we will provide an overview of Monte Carlo simulation and its applications in algorithmic trading. We will discuss how to implement Monte Carlo simulation in Python, and provide some examples of how it can be used to evaluate the performance of a trading strategy.

What is Monte Carlo Simulation?

Monte Carlo simulation is a computational method that uses random sampling to model the probability of different outcomes in a given situation. It is named after the Monte Carlo Casino in Monaco, where gambling is based on chance and probability.

The method was first developed in the 1940s by a group of scientists working on the Manhattan Project. They used it to model the behavior of neutrons in a nuclear reactor. Since then, Monte Carlo simulation has been used in a wide range of fields, including finance, engineering, and physics.

In finance, Monte Carlo simulation is used to model the potential outcomes of a trading strategy. It can be used to simulate the performance of a trading strategy under different market conditions, and to estimate the probability of different outcomes, such as profits and losses.

How Does Monte Carlo Simulation Work?

Monte Carlo simulation works by generating a large number of random samples based on a set of assumptions about the underlying system. These samples are then used to model the behavior of the system and to estimate the probability of different outcomes.

In algorithmic trading, Monte Carlo simulation can be used to model the performance of a trading strategy under different market conditions. For example, it can be used to simulate the performance of a trading strategy during a bull market, a bear market, or a sideways market.

To implement Monte Carlo simulation in algorithmic trading, we need to define a set of assumptions about the underlying system. These assumptions can include the expected return, volatility, and correlation of the assets in the trading strategy.

Once we have defined the assumptions, we can generate a large number of random samples based on these assumptions. Each sample represents a possible scenario for the market, and the performance of the trading strategy under that scenario can be evaluated.

By generating a large number of samples, we can estimate the probability of different outcomes, such as profits and losses. This can help us to identify the strengths and weaknesses of a trading strategy, and to make informed decisions about how to improve it.

Implementing Monte Carlo Simulation in Python

Python is a popular programming language for algorithmic trading, and there are several libraries available for implementing Monte Carlo simulation. One of the most popular libraries is NumPy, which provides support for numerical computations in Python.

To implement Monte Carlo simulation in Python, we first need to define the assumptions about the underlying system. For example, we might assume that the expected return of a particular asset is 0.05, the volatility is 0.2, and the correlation with another asset is 0.7.

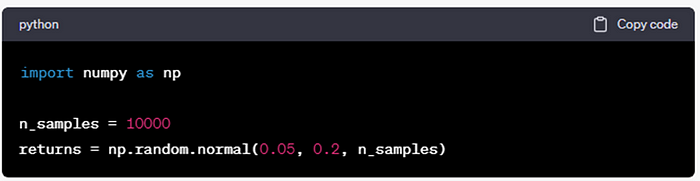

Once we have defined the assumptions, we can generate a large number of random samples using NumPy. For example, we might generate 10,000 samples using the following code:

In this example, we are generating 10,000 samples of returns using the np.random.normal function, which generates random samples from a normal distribution with a mean of 0.05 and a standard deviation of 0.2.

Once we have generated the samples, we can use them to evaluate the performance of a trading strategy. For example, we might evaluate the performance of a simple moving average crossover strategy, where we buy when the short-term moving average crosses above the long-term moving average, and sell when the short-term moving average crosses below the long-term moving average.

To evaluate the performance of the strategy, we can calculate the profit or loss for each sample, and then calculate the average profit or loss and the standard deviation. We can also calculate the probability of different outcomes, such as the probability of making a profit or the probability of making a loss.

Here’s an example of how to calculate the profit or loss for each sample:

In this example, we are using the rolling mean function np.roll to calculate the short-term and long-term moving averages. We then generate buy and sell signals based on the crossing of these moving averages.

We calculate the profit or loss for each sample by comparing the closing price at the buy or sell signal with the closing price short_ma days later. If we have a buy signal, we calculate the profit as the difference between the closing price at the buy signal and the closing price short_ma days later. If we have a sell signal, we calculate the profit as the difference between the closing price at the sell signal and the closing price short_ma days later.

Once we have calculated the profit or loss for each sample, we can calculate the average profit or loss and the standard deviation:

We can also calculate the probability of different outcomes using the cumulative distribution function (CDF) of the returns:

In this example, we are using the norm.cdf function from the SciPy library to calculate the CDF of the returns. We calculate the probability of making a profit as 1 minus the CDF at 0, and the probability of making a loss as the CDF at 0.

Applications of Monte Carlo Simulation in Algorithmic Trading

Monte Carlo simulation can be used in a wide range of applications in algorithmic trading. Here are some examples:

- Evaluating the Performance of a Trading Strategy: Monte Carlo simulation can be used to evaluate the performance of a trading strategy under different market conditions. By generating a large number of random samples, we can estimate the probability of different outcomes, such as profits and losses, and identify the strengths and weaknesses of the strategy.

- Optimizing the Parameters of a Trading Strategy: Monte Carlo simulation can be used to optimize the parameters of a trading strategy. By generating a large number of random samples with different parameter values, we can identify the parameter values that produce the best results.

- Estimating the Risk of a Portfolio: Monte Carlo simulation can be used to estimate the risk of a portfolio. By generating a large number of random samples of the returns of the assets in the portfolio, we can estimate the probability of different outcomes, such as the probability of a large loss.

- Backtesting a Trading Strategy: Monte Carlo simulation can be used to backtest a trading strategy by simulating the performance of the strategy using historical market data. By generating a large number of random samples of the historical data, we can estimate the performance of the strategy under different market conditions and identify any issues or limitations of the strategy.

Conclusion

Monte Carlo simulation is a powerful tool for algorithmic traders, as it allows them to evaluate the performance of their trading strategies, optimize the parameters of their strategies, estimate the risk of their portfolios, and backtest their strategies using historical market data. By generating a large number of random samples, Monte Carlo simulation provides a comprehensive view of the possible outcomes of a trading strategy and helps traders make informed decisions.

However, Monte Carlo simulation is not without limitations. It relies on assumptions about the distribution of returns, which may not hold true in practice. It also requires a large amount of computational power and may take a long time to run. Additionally, Monte Carlo simulation cannot account for events that are not included in the historical data, such as unexpected market events or changes in market conditions.

Despite these limitations, Monte Carlo simulation remains a valuable tool for algorithmic traders, as it provides a comprehensive view of the possible outcomes of a trading strategy and helps traders make informed decisions. By understanding the principles of Monte Carlo simulation and how to apply them in practice, algorithmic traders can improve the performance of their strategies and achieve better results in the markets.

📈 Would you like to learn learn how build trading bots? Visit AlgoPro today!

No previous knowledge of coding needed, we take you from zero to the top 💯 All the way to building, testing and deploying your own algorithms.

Watch your income skyrocket by mastering the power of coding!

🔗 Join our FREE Discord Channel!

🔗 Follow us on Twitter